344 Regulations in terms of Paragraph e of Definition of Research and Development in section 11D1 of the Income Tax Act 1962 on Criteria for Clinical Trials in respect of Deduction for Research and Development dated 23 April 2015. U Section 3h insofar as VAT exemption is concerned of RA.

Things That Might Seem Tax Deductible But Actually Are Not

PART I Income Tax DIVISION A Liability for Tax.

. December 11 1997. This is your HERO GUIDE here. Where there has been use of different car expense methods Subdivision 40-E--Low-value and software development pools 40420.

Sports and recreation 3095. Omitted vide Direct Tax Laws Amendment Act 1987 wef. Sports equipment for sports activities defined under the Sports Development Act 1997 including golf balls and shuttlecocks but excluding motorised bicycles and payment for gym membership.

T Section 25 insofar as VAT exemption is concerned of RA. Meaning of unallowable purpose 443. 8502 or the Jewelry Industry Development Act of.

In February the President submitted the first plan to finish the job of eliminating the deficit and the balanced budget in 27 years. INCOME TAX ASSESSMENT ACT 1997. Developed country disaster relief funds 3090.

Tax payable by persons resident in Canada 2 1 An income tax shall be paid as required by this Act on the taxable income for each taxation year of every person resident in Canada at any time in the year. Individual and dependent relatives. The version of the Act as at 31 December 2000 was revised and consolidated by the Law Reform Commission of Uganda.

Taxable income 2 The taxable income of a taxpayer for a taxation year is the taxpayers income for the. Motorised equipment bicycles treadmills and club memberships that provide the use of gym facilities are. On August 5th he signed the Balanced Budget Act of 1997 which finished the job of eliminating the 290 billion budget deficit.

Heres a more detailed look at the fine print behind each income tax relief you can claim in 2020 for YA 2019. Sports equipment for sports activities is defined under the Sports Development Act 1997. Want the Ultimate Expert Step-by-Step Guide to Maximize your Malaysian Income Tax Relief and Deduction within LHDN Guideline.

58 of 1962 has been amended by Government Gazette 38730 Notice No. Those changes will be listed when you open the content using the Table of Contents below. All subsequent amendments have been researched and applied by LawsAfrica for ULII.

Purchase of sport equipment for any sports activity as defined under the Sport Development Act 1997 excluding motorized two-wheel bicycles. Transactions not at arms length. PL 105-34 signed 8597 500 per Child Tax Credit.

S Section 4c and f insofar as VAT exemption is concerned of RA. The extensive list of sports equipment eligible for tax relief in Malaysia includes golf balls and shuttlecocks and payment for gym memberships. AN ACT AMENDING THE NATIONAL INTERNAL REVENUE CODE AS AMENDED AND FOR OTHER PURPOSES.

Reduction of expenditure by reference to regional development grant. The Income Tax Act 1962 Act No. Loan relationships for unallowable purposes.

Income Tax Act Chapter 340. There are outstanding changes not yet made by the legislationgovuk editorial team to Corporation Tax Act 2010. This Act shall be cited as the Tax Reform Act of 1997.

Restriction of relief for interest where tax relief schemes involved. Unallowable purposes and tax relief schemes. Transactions not at arms length.

Additional lifestyle tax relief related to sports activity expended by that individual for the following. 989 SECTION 228A. Purchase of sports equipment for any sports activity as defined under the Sports Development Act 1997 exclude motorized two-wheel bicycle and gym memberships for spouse.

8492 or the National Museum Act of 1998. Payment of rental or entrance fee to any sports facility. Be it enacted by the Senate and House of Representatives of the Philippines in Congress assembled.

8292 or the Higher Education Modernization Act of 1997. Commenced on 1 July 1997 This is the version of this document as it was at 31 December 2000 to 30 June 2001 Note. Recovery of tax in pursuance of agreements with foreign countries.

Tax Relief Helps Ease Financial Burden

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Tax Relief Ya 2021 9 Things You Should Know When Doing E Filing In 2022

Aggregate To Total Income Acca Global

Cheng Co New Update Caution Common Mistake Tax Facebook

Tax Relief Ya 2021 9 Things You Should Know When Doing E Filing In 2022

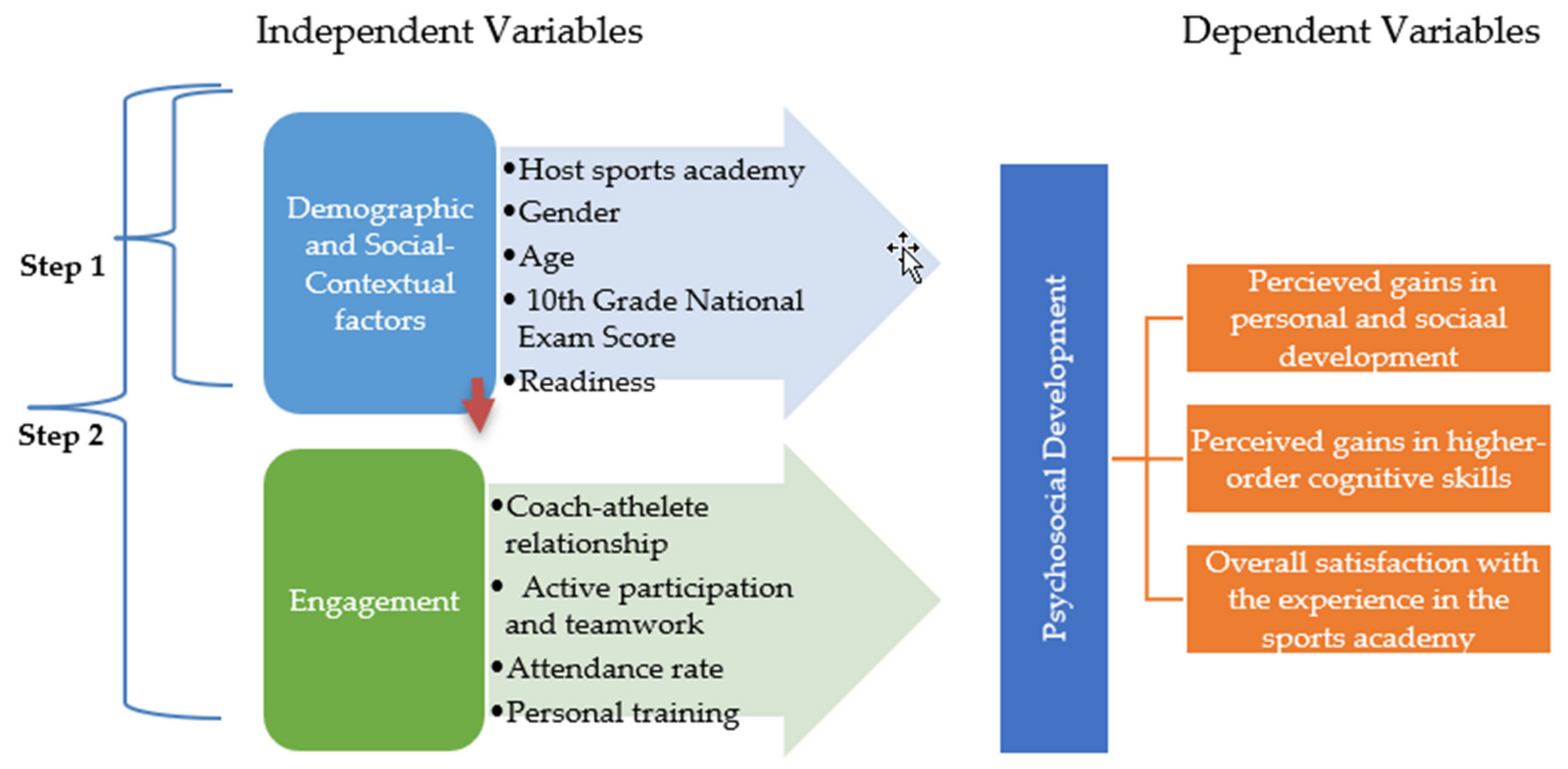

Sustainability Free Full Text Sports Academy As An Avenue For Psychosocial Development And Satisfaction Of Youth Athletes In Ethiopia Html

Tax Relief Ya 2021 9 Things You Should Know When Doing E Filing In 2022

Tax Relief Helps Ease Financial Burden

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Things That Might Seem Tax Deductible But Actually Are Not

Things That Might Seem Tax Deductible But Actually Are Not

Tax Relief Ya 2021 9 Things You Should Know When Doing E Filing In 2022